How does it work?

1

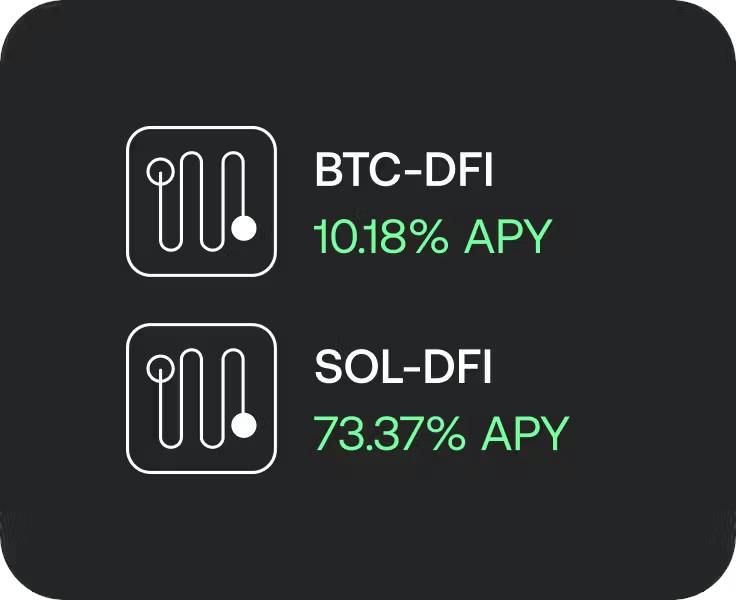

Choose a pair

Crypto assets are added into a liquidity pool on the DeFiChain blockchain to increase the amount of market liquidity, which results in higher trading volume, increased price levels, and lower volatility.

2

Earn rewards

In exchange for providing liquidity, you’ll earn a share of the swap fees and blockchain rewards.

3

Sit back and relax

Rewards are paid out every 12 hours and are immediately available in your Bake wallet.

Questions? Answers

WHAT IS A LIQUIDITY POOL?

The basic rationale of liquidity pools is simple. For transactions to happen in DeFi, there needs to be crypto, and liquidity pools serve the same purpose as market makers in traditional finance. Liquidity pools on the DeFiChain blockchain consists of crypto pairs and are used to facilitate trades between digital assets on the DeFiChain DEX (Decentralized Exchange), where anyone is allowed to “pool” their crypto and supply liquidity.

WHAT IS DEFICHAIN?

DeFiChain is a decentralized, open-source blockchain platform launched by DeFiChain Foundation to enable DeFi services, such as borrowing, lending and other investment products. The goal is to make DeFi services seamlessly accessible to everyone within the Bitcoin ecosystem.

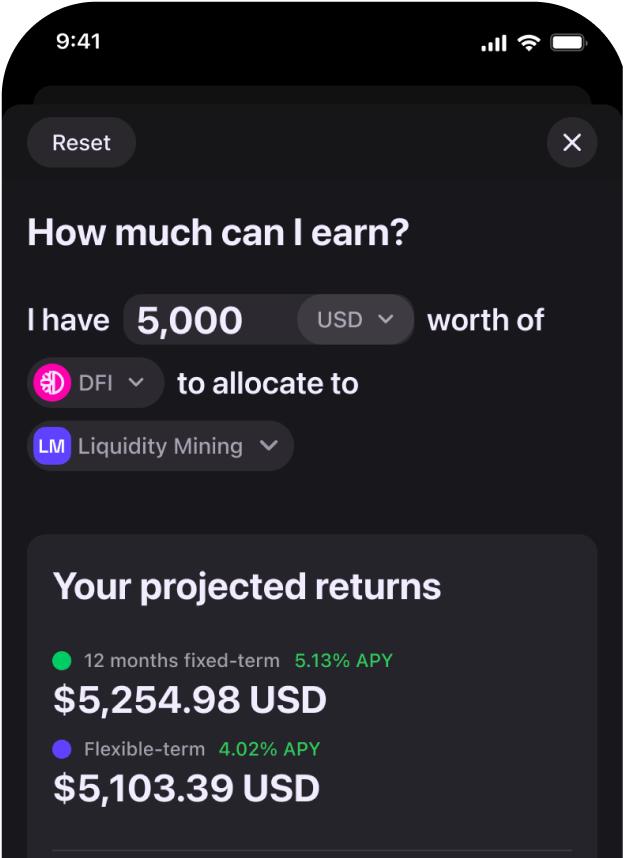

WHAT IS THE MAIN BENEFIT OF CAKE DEFI’S LIQUIDITY MINING SERVICE?

Users can generate competitive yields on two types of crypto in an easy, secure and transparent manner. Participating in liquidity mining is a technically complex process, and you may feel that the investment required is too great. Doing it on Cake DeFi helps to ease that process with our simple and secure service.

WHAT IS THE MAIN RISK OF LIQUIDITY MINING?

Impermanent loss, which occurs when a user deposits funds at one price and then withdraws at a lower price. This happens as liquidity pools are constantly adjusting to maintain an equal proportion of tokens. And as the prices of digital assets change, the balance of crypto assets in the pool also changes.

CAN I WITHDRAW MY FUNDS FROM THE LIQUIDITY MINING SERVICE ANY TIME?

Yes. There’s no lock-up period involved.

ARE THE REWARDS IN LIQUIDITY MINING GUARANTEED?

Though rewards are generated every 12 hours and are immediately available in your Cake DeFi wallet, keep in mind that the yields generated are subject to the crypto market’s volatility and other external factors that Cake DeFi has no control over.

I ONLY HAVE ONE CRYPTO TOKEN, CAN I STILL ALLOCATE MY ASSETS TO LIQUIDITY MINING?

Yes. Our ‘simple mode’ allows you to convert a portion of your crypto into the other pair and in the required amount.

WHAT ARE THE FEES FOR PARTICIPATING IN LIQUIDITY MINING ON CAKE?

The APY shown is net of all fees, so the APY that you see is the rate that you will get. Cake’s commission for Liquidity Mining service is 15% of the rewards generated. There are no fees to take your assets out from Liquidity Mining.

Get the app

Discover new ways to build and grow your digital assets portfolio. Over 1 million people trust Bake.